The End Is Here: Cable's Media Dominance

On September 7, 2017, media stocks were shaken by reports from Disney (NYSE:DIS) and Comcast (NASDAQ:CMCSA) at the Bank of America Merrill Lynch investor conference. Disney announced essentially flat revenue and earnings for 2017 – after years of growth. Comcast announced anticipated subscriber attrition of 100,000-150,000 in the quarter after years of uninterrupted growth.

Is this simply an anomaly? Or, is the acceleration of an existing trend?

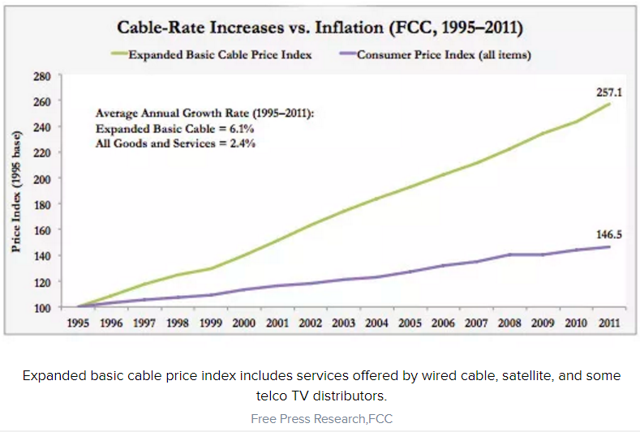

Media TrendsAfter an introduction, 50 years ago, as an inexpensive method of television viewers gaining clear reception from their local stations, Pay TV evolved to become the center of media consumption in the household. Cable channels ballooned to the hundreds. Music channels for every taste emerged. The home television opened up to the world. Costs have risen commensurately and significantly faster than the rate of inflation.

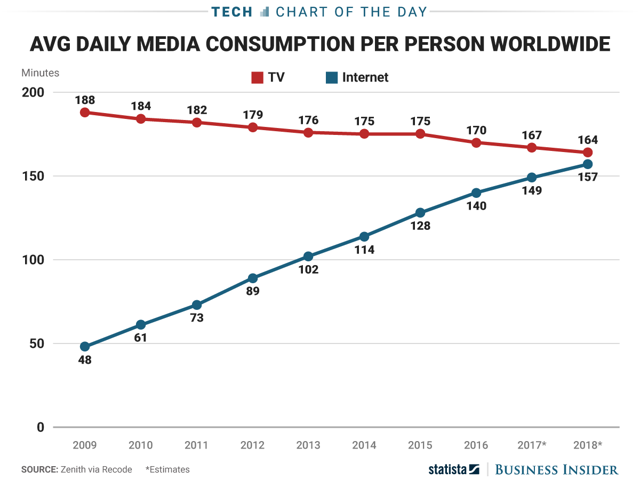

In the meantime, the Internet emerged as a new technology. All consumers, and particularly those who've grown up with the Internet, have found a new level of interactivity, an ability to summon programming on demand, and a much broader range of content.

These and other trends are evidence of a cultural change that is having, and will continue to have, a dramatic impact on the media industry. The Pay TV industry, which has served the American public for decades, is being transformed as well. The well-known ESPN growth and decline trend peaked earlier and has been more dramatic. But subscriber behavior in regard to sports programming appears to presage a broader decline in the traditional Pay TV market. Satellite subscribers – a smaller number – have faced similar declines.

Internet Streaming – Cable's Successor in the WingsNetflix created the platform of media's future in 2007. However, the impact on the Pay TV was modest - at least initially. By dusting off the vaults of the major studios and bringing to life their creative work of nearly a century, Netflix didn't compete with, but rather augmented existing media viewing habits, as current programming was not available on the service.

The first step towards competition came in 2013 when Netflix (NFLX) entered the content production industry. The new series created a stir in the critical and public audiences and made Netflix a "must-see" among a younger cohort.

Netflix has not entered the business of attempting to compete with traditional cable, other than offering an alternative. But, at a cost of $7.99 when introduced, adding the service to existing cable services increased the household media budget only modestly. Even today, from 50 to 75% of all Netflix subscribers have simply added that to their existing media consumption.

Anticipating the future, a consortium of content producers formed Hulu. Today, Disney, 21st Century Fox, Comcast and Time Warner (NYSE:TWX) constitute the ownership. This over the top (OTT) streaming Internet service was intended to both present library content as well as delayed broadcasts of current programming of each of the owners. In addition, Hulu carries shows from networks such as A&E, Big Ten Network, Bravo, E!, Fox Sports 2, FX, PBS, NFL Network, Oxygen, RT America, Fox Sports 1, Esquire Network, SundanceTV, Syfy, USA Network, NBCSN, and online comedy sources. Total viewership is estimated at 32 million.

However, all of these OTT, direct to consumer services which bypassed cable and satellite fell short of a true Pay TV experience. Archived material is enjoyable, but not contemporary. Delayed broadcasts are fine but put one out of sync with the rest of the viewing world. So, again, these were typically added to an existing PayTV service rather than replacing it – the use being able to see programs on demand without having to record them.

Cable providers have been reluctant to provide either skinny bundles or streaming options. Their moves into the streaming arena have been tentative. Their intuition that "digital pennies don't add up to analog dollars" is accurate. Any of these options promised lower revenue and nearly invisible profit and margin while cannibalizing the customer base. And, that's the best case.

The Satellite Business ModelHowever, satellite operators have been much more willing to enter the streaming world. The difference in technology between cable and satellite operators drives rather different business models, which has provided divergent incentives in developing streaming business units.

Cable providers offer a bundle of services, including Internet, phone in addition to cable television. Satellite providers offer only PayTV. If a cable subscriber drops cable to go "over the top," the company still provides the Internet service the client requires to access Netflix and other streaming services.

However, if a satellite customer drops PayTV, the company has lost the customer entirely. This has given a rather different incentive to this subgroup of MVPDs. In a media world increasingly abandoning traditional PayTV for streaming content over the Internet, the future of satellite Pay TV would simply be near complete dissolution of their customer base.

Satellite Strategy - Sling and Dish TVDISH TV (DISH), remaining a separate entity, chose a different approach. It chose to make the best of its situation and develop a streaming service which would offer a broad range of network programming in real time. Its offering – Sling – matched with an antenna for local stations constitutes a Pay TV equivalent. Thus, it has earned the name of a "Digital MVPD" (AKA "Virtual MVPD"). The service is offered to any consumer over the Internet – this is a separate delivery and contracting compared to Dish' satellite services. Because of its early entry into the market and ubiquitous availability, it has gained a strong foothold in the market. And, with its monthly service starting at $20 – half the cost of competitive cable slim bundle offerings – it has retained first place in the Digital MVPD arena with estimates of over one million subscribers at present.

Satellite Strategy - DirecTVDirecTV resolved the issue with a merger with AT&T – which complemented both company's offerings. AT&T (NYSE:T) gained access to television services and DirecTV gained the Internet access and phone service.

Cable's Entry into StreamingCable companies have been a bit slower to respond. The very first attempts avoided conflicts with content providers by offering local television stations and the option for premium HBO and Showtime services.

In the spring of 2015, Verizon (NYSE:VZ) released its first skinny bundle – with popular cable programs, local stations, and the option to add "bundles" a la carte. However, the bundle excluded ESPN – and this was widely understood as a test of its contractual relationship with content suppliers. Disney filed suit. The parties settled a year later. Terms were not disclosed, but ESPN relaunched its bundled service with 2 channels - one named "Essentials" and the other "Sports & More." Essentials still omit ESPN.

Summer 2016 - Après Moi, le DélugeWith pressure from consumers to introduce alternatives to traditional PayTV service, with the success of Sling, and the anticipated release of more streaming services, most major MVPD and Digital MVPD services have responded with additional offerings – late in 2016 and a flood in 2017.

The average cost for basic cable currently runs $100 a month.

By contrast, OTT services start at about:

Typically, consumers will choose a handful of services as none provides a complete solution in this a la carte world; even still, the total package of services runs significantly less than the $100 average Pay TV bill. The following listing is intended to be comprehensive, but is not exhaustive and is as accurate as I've been able to research. Information will continue to change. Services bolded have been released in the past year, since the summer of 2016.

OTT

$10

Archived television.

2006

Amazon Prime Video

OTT

$8.99

Movies –licensed, HBO, and exclusive content.

9/2006

Apple (AAPL)

OTT

-

Pay per view & "apps".

2008

OTT

$10.00

Delayed, current television shows

2008

CBS (CBS)

OTT CBS live stream

$5.99

CBS exclusively. Limited sports

11/2014

Dish

OTT Skinny

$20.00

1st true "skinny bundle" with live streaming. Self-styled "a la carte television"

1/2015

FiOS

VOIP Phone Multi-device + subscriber OTT

Subscribers only

4/2105

Comcast

Xfinity Stream TV

Cable Multi-device

Subscribers only

7/2015

Verizon

go90

OTT

free, ad-supported

Selection of TV shows, movies, clips. Like YouTube

11/2015

Sony

OTT Skinny

$40

3/2016

Apple

OTT Skinny

"a la carte" through downloadable content apps

6/2016

AT&T

OTT Skinny

$35

11/2016

Google (NASDAQ:GOOG) (NASDAQ:GOOGL)

OTT Skinny

$35

4/2017

Hulu

OTT Skinny

$40

6/2017

Charter (CHTR)

Cable Skinny

$60

Subscribers. Alt device streaming.

6/2017

Charter

Spectrum Stream

OTT Skinny

$20

Limited avail – cord cutters. Service area.

6/2017

CenturyLink (CTL)

VOIP Phone Skinny

$70

6/2017

OTT Skinny

?

2H 2017

Comcast

OTT Skinny

$15?

Local stations, 1 premium. ? Limited to

2H 2017

Altice (AMS: ATC)

Cable Skinny

?

Investigating

TBA

Frontier (FTR) (Dialup/Cable)

OTT Skinny

?

Trial with Tivo

TBA

OTT Skinny

?

Rebrand DirecTV Now

TBA

TermsOTT

Over the Top streaming content. Without further description, this indicates archival movies and television shows.

Delayed

delayed broadcast of current network television shows – typically a day or two, up to a week.

Live Stream

live availability of current network content as on PayTV.

Network designation

only current and archived programming of the network.

Skinny bundle

a bundle of PayTV channels smaller than typical options – live streamed as on a PayTV service. Can be either provided as a cable option to existing cable subscribers, or OTT to anyone with Internet connectivity.

VOIP

Voice over IP. A phone network such as Verizon FiOS or AT&T UVerse which is based on contemporary networking hardware and protocols rather than Alexander Graham Bell's twisted pair or DSL (same hardware).

Multi-device

OTT content available to existing PayTV customers to allow them to live stream content on devices – such as desktops, laptops, smartphones, tablets – other than television sets.

What's the Motivation and Target Audience Cable CompaniesCable Companies are making available one or both of two different kinds of Skinny cable bundles for current cable subscribers. The difference is the delivery model – cable or OTT on the Internet.

Typically, cable providers will offer their services – both cable and OTT streaming – only to their own customers. This capitalizes on one advantage that traditional MVPDs have: local network programming.

Digital MVPDsStrictly Digital MVPDs as well as satellite operators – Apple TV, Sling, Hulu TV, Google TV, Sony PlayStation Vue, AT&Ts DirecTV – have, in the past year, either expanded or created new offerings to provide traditional Pay TV equivalents.

For example, Hulu started out over a decade ago with access to media libraries and delayed streaming of current network programming. In June of this year, a new service was inaugurated – Hulu TV – which offered live streaming of current network programming, along with some local programming.

There are many constraints. Content creators license at the same rate as for traditional MVPDs. Economics play a role in restricting the customizability of Digital MVPD offerings. Yet, the potential is there, and some, such as Sling, have created truly innovative services.

ComparisonThe offerings overlap a good deal. In general, cable companies offer access to local stations' network programming – which is important for many consumers. Virtual MVPDs provide this, if available, only in select metropolitan areas. Local programming is particularly important for older viewers.

Virtual MVPDs typically offer distinctive programming available only through their service – Netflix being the prime example. This is particularly important for younger viewers.

How will these Offerings attract their Target Audience?It makes sense to divide the audience into two groups – Millennials and non-Millennials. The Internet has introduced a cultural divide, and that is expressed well enough by this distinction.

Millennials and CableMillennials have grown up with computers, computer technology, and, since the mid-90s, the Internet. We're beginning to see what a cultural transform this has brought as this cohort ages into adulthood.

The Internet has brought so many changes – open access to information, a new world of content, interactivity through games and social media. The new cohort has adapted to this environment, communicating on different mechanisms than before such as messaging, developing new support networks. And, indeed, a new culture has emerged, which is served by the new streaming services that have emerged.

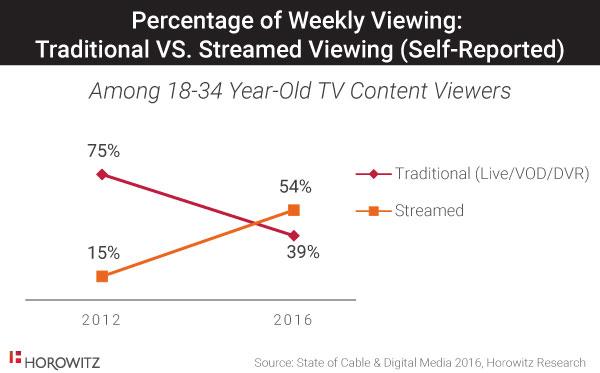

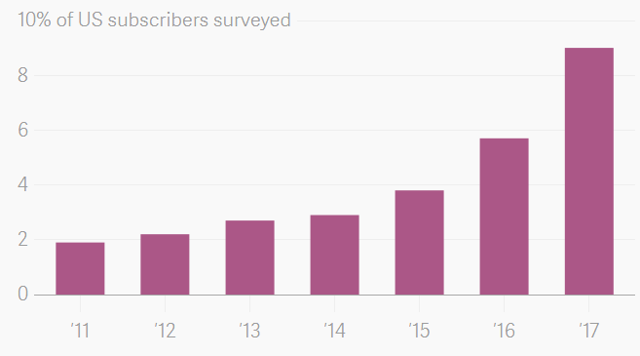

The change in behavior has already occurred in the cohort now reaching the age of settling down, creating households and making lifestyle decisions about media. The trend noted in the graph below has continued into 2017 – where, according to a recent survey – only 33% of Millennials 24-35? have or plan to subscribe to Cable, and another 9% plan to drop it in the next year. The restrictions of cable seem quaint, by contrast to the Internet and streaming content it provides.

Cord nevers may be attracted by the slimmed down ultra-basic bundles offered by cable companies. But, these will compete with other comparable Digital MVPD services from Netflix and others at a similar price point and probably a disadvantage in content.

Non-Millennial ImpactBut, the question of the non-Millennial group - the rest of the population – about 75% - has been less fully analyzed. It is my proposition that over the next several years, this group's abandonment of the traditional cable package will drive a larger decline than has been anticipated to this point.

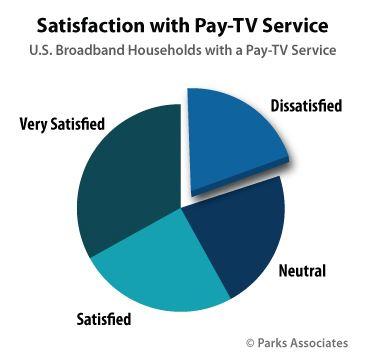

Now, to be clear, a majority of Americans are satisfied with their cable service. Cable is not going away in the next 3 years. However, its near dominance of the market is ending, as streaming media takes an increasingly prominent place in the market. We want to look, at this point, at the equivocal support, the desire to change, to understand the cracks in the fortress which PayTV has created through duopoly monopolization of content delivery.

Even though most are satisfied or very satisfied with their current PayTV service, nearly half are either neutral or dissatisfied – the latter amounting to 20% in this survey. More concerning is the noticeable drop over the past 4 years. The dissatisfaction rate has doubled since 2013.

The concerns that consumers have identified include:

The graph below displays that dissatisfaction may well be turned into action. In 2017, 9% of those surveyed said they intended to drop their cable subscription in the next year.

Is the End of Cable's Media Near Dominance Really Here?

For non-millennials to migrate to either Skinny Bundles or Digital MVPDs, the keys seem to be: simplicity, flexibility, and local programming. Non-Millennials haven't developed the same cultural context, technical sophistication or peer support to adopt this approach.

It seems that cable-based Skinny Bundles will be particularly attractive as a base, with a separate streaming service for extra content.

Local programming will be an issue for Virtual MVPDs outside of major metro areas

Although not perfect, and still more tailored to the benefit of the content distributors than to consumers, the new alternatives are a lot more attractive than current Fat Bundles. This suggests that the likelihood is very good.

It is my contention that the current new entrants into the marketplace in 2017 will make a profound and permanent change in the behavior of non-millennials going forward.

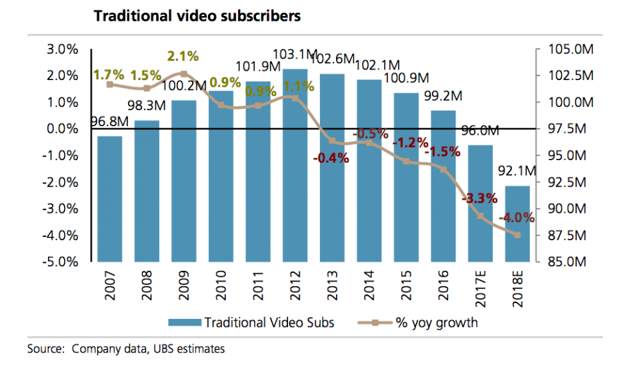

Some analysts have suggested a constant 2.5% attrition rate on traditional Pay TV subscriptions. This represents a snapshot of the industry today. U.S. pay TV business to lose 10.8M more subscribers by 2021, Kagan predicts The Business Insider analysis noted in the graph above suggests a drop of 3.3% in 2017 and 4.0% in 2018. However, as suggested by the flood of new services in 2017 as well as increasing dissatisfaction with Fat Bundles, this likely is an understatement.

I would not be surprised to see a rate of attrition of traditional Pay TV services reaching to between 4% and 6% within the next 3 years.

Investment ImplicationsThere are more shocks to come in next year as the industry encounters a likely dramatic shift in media consumption. It will be challenging several years.

Digital Pennies don't add up to Analog DollarsAll MVPDs will find that the economic model for streaming services and Skinny Bundles is much different than traditional PayTV content delivery.

We'll make it up on VolumeAn independent analysis of AT&T's DirecTV Live suggested that the service provided $3 gross margin, -$1 net margin, when a typical satellite customer provided $65 in gross margin.

The bottom line is that, for this competitive and shakeout period, a customer that drops traditional cable and subscribes to an OTT skinny bundle has the economic impact of a lost customer. 1/3rd to ½ the revenue, loss of margin, loss of profit. Pay TV companies can continue to count OTT subs for advertising, but advertising contributes only about 12% of the total subscriber fee + advertising revenue sources.

The streaming services will squeeze revenue, margins, and profit in their cable divisions and likely cannibalize some of their customer base. At least, some customers will remain in the content distribution ecosystem and all will likely use broadband connectivity. That's for companies that provide broadband.

Cable companies that don't offer Skinny Bundle options will face more significant subscriber attrition but those customers will likely remain broadband subscribers at a lower revenue rate.

StocksThe stocks of media companies have been under stress over the past several years, so it seems that these concerns have been factored in, to some degree, into equity prices. It appears that that stress will continue over the near term.

AT&T (the largest domestic PayTV provider), by contrast, entered the fray with DirecTV Now as an OTT skinny bundle. After a stumbling start, the service will be a good test case of a mainstream Skinny Bundle offered nationally. This may be a good test case of the viability of streaming services provided by traditional MVPDs.

Comcast, is the largest broadcasting and cable television company in the world by revenue and second largest domestic PayTV provider. It has sent mixed messages. Comcast has announced the release of a slim bundle priced at $15 to attract millennials – to be released in the fall of 2017. At the same time, it has recently stated that it will not pursue low margin customers, preferring to enhance and tier services at the higher margin level. With the current very negative customer attitude towards Comcast's customer service, it would seem that the company has little loyalty to build upon.

On the other hand, Comcast is the largest media company in the world, combining the range of distribution channels and content creation. It may well be that other companies, such as AT&T are doing now with its anticipated merger with Time Warner, is that content creators find that vertical migration with distributors is the wave of the future. Other companies, such as Disney, may fall into a similar consolidation.

The stress of the economics of adding streaming, as well as PayTV sub attrition, will likely put smaller operations in play for acquisition or divestiture. Look for industry consolidation, particularly among the many small, local cable companies that are not publicly owned. Rural cable and phone providers have their own rather specific technological and competitive environment. When 5G cell transmission is widely available, this will significantly impact this environment.

Dish TV was the first to offer a true, nationally available, Skinny Bundle. The limitation of its satellite technology – no broadband – was the necessity that drove its invention. It has remained the most interesting and flexible of the Skinny Bundles now available and has as large a subscriber base as all other OTT alternatives combined. In a sense, this effort is a "canary in the coal mine" to determine the programmatic and financial structure leading to success in the streaming world.

Other Digital MVPDs are familiar with digital economics. However, the ability to invest in content creation, and particularly, the ability to garner a loyal subscriber base as Netflix has managed to do, will spell success or failure for individual efforts. And, in the massive investment in new content, current creators may well create a new "classic" repertoire of media, just as Walt Disney did a hundred years ago.

Over the Near TermThank you for reading this Seeking Alpha PRO article. PRO members received early access to this article and get exclusive access to Seeking Alpha's best ideas. Sign up or learn more about PRO here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments