Shutterstock - Value In High Resolution

Analyst: James Sun

We believe Shutterstock's last three disappointing quarters are not indicative of its future growth prospects, and we remain optimistic about the transition to a broader and more creative platform as one that will accelerate revenue growth and expand margins through a successful expansion into adjacent markets. We believe the market and most brokers are not fully appreciating Shutterstock's current transition, and are valuing it purely as a stock photo repository.

Company ProfileShutterstock, Inc. (NYSE:SSTK) or "the Company" is a global online provider of royalty-free stock photos, videos, and audio, as well as creative editing tools, used commonly in marketing materials, editorial publications and websites. Founded in 2003, SSTK has one of the largest databases of digital stock content and is currently the only publicly-traded company of its kind.

Transition to A Creative Platform Provides A Runway For Revenue Growth And Margin Expansion

We see the expansion to a platform that includes various content offerings and tools for professionals in the creative design process as a rebranding of SSTK and a key revenue driver beginning in FY2018. This transition opens up adjacent markets in the Creative space to offer significant cross-selling opportunities. Furthermore, we expect EBITDA margins to expand back to at least pre-transition levels (~23%) as current investment spending lightens.

Shutterstock Is Well-Positioned In The Competitive, Yet Growing Stock Content Industry

With the number of crowd-sourced social photo start-ups growing, we see the industry becoming increasingly competitive. However, we believe the Company's technology, established partnerships, and responsiveness to industry trends labels it as a market leader in stock content.

Valuation

Our target share price of $47.00 is weighted 50% on our 5-year DCF assuming a 9.5% WACC ($37.00/share) and a 2.0% perpetuity growth rate, and 50% on a 14.4x EV/ FY2018E EBITDA multiple ($56.00/share).

Business Overview/FundamentalsCompany Overview

Shutterstock operates one of the world's largest repositories of royalty-free stock imagery and other related content. Its diverse selection of content is used in various verticals including marketing, corporate communications, editorial publications, film production and website creation. Unlike traditional stock photo agencies, which are higher priced and more exclusive in terms of content submission, SSTK is considered a "microstock" agency that enables and encourages all contributors, regardless of skill level or profession, to upload imagery.

Founded in 2003 by its current CEO, Jonathan Oringer, SSTK gained popularity over established competitors, such as Getty Images, through its competitive and economic licensing and pricing system. SSTK's initiation of its "royalty-free" licensing agreement enabled customers to have unlimited access and usage rights to an image after purchase. SSTK's pricing involves either a pay-per-download system or a monthly or annually-recurring payment for a daily allowable number of downloads. As of Q2-2017, Shutterstock had over 140 million images in its collection (49.4% CAGR from FY2012 – FY2016) and over 1.7 million active customers (20.5% CAGR from FY2012 – FY2016).

Exhibit 1: Shutterstock's Image Collection Samples

Source: Shutterstock, Offset

Revenue & Product Mix

SSTK offers licenses for a variety of content types; however, the majority is royalty-free imagery. SSTK's brands and content offerings across its E-Commerce platform are shown below:

Exhibit 2: Brands And Content Offerings

Brands

Offerings

Shutterstock

-Imagery (photographs, vectors, illustration) and video clips

-SSTK's flagship brand in which it derives the majority of its revenue

Bigstock

-Unique imagery and video clips tailored to cost-sensitive independent creators

Flashstock

-Creative platform that enables the efficient creation of custom content for marketers

Offset

-More expensive and higher-end imagery, each priced between $200 - $500

-Belonging to respected collections, such as National Geographic

Shutterstock Music

-Audio tracks and sound effects

-Includes Premiumbeat, which provides high-quality, exclusive music

Shutterstock Editorial

-Editorial imagery (entertainment, sports, and news)

-Includes RexFeatures, a leading independent European agency

Source: Company filings

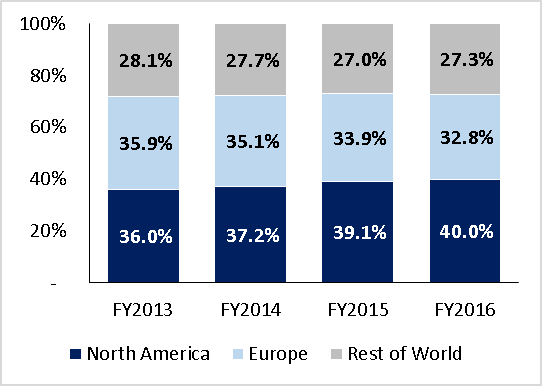

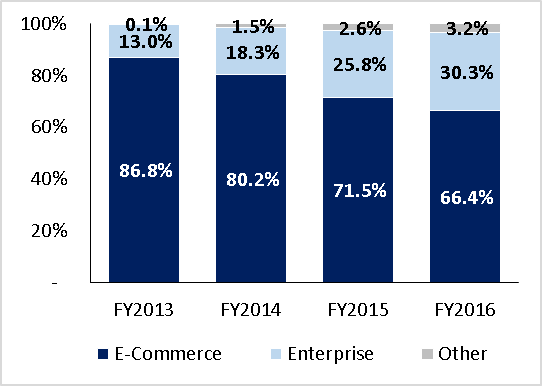

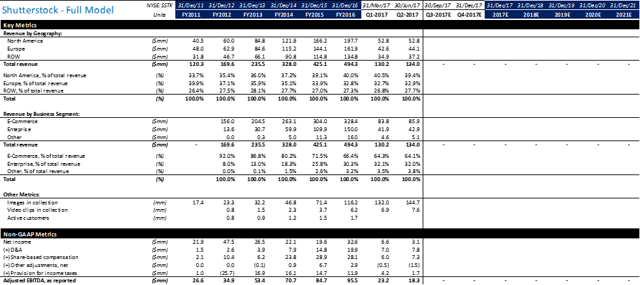

SSTK's revenue breakdown by geography and business segment over the last four fiscal years can be seen below, with further data available in Appendix 5: Key & Non-GAAP Metrics.

Exhibit 3: Revenue By Geography Exhibit 4: Revenue By Business Segment

Source: Company Filings

Shutterstock is universally recognized as a leading stock image provider, retaining a consistent geographic mix thanks to its global sales presence and its platform's functionality in 20 languages. With the top 25 customers representing only 2% of revenues in FY2016, SSTK is truly diverse in its revenue generation.

Shutterstock reports in three operating segments:

1) E-Commerce: Customers who download on a pay-per-download scheme or on a subscription plan paid on monthly or annually recurring basis

2) Enterprise: Creative professionals or large organizations with unique needs such as non-standard licensing rights, multi-seat access, and workflow management

3) Other: Digital asset management offerings through annual SaaS subscriptions

Since Enterprise clients offer a ~10x greater spend than subscription-based clients and have higher retention rates, SSTK has been identifying the adoption of more Enterprise clients as a growth driver. By initiating partnerships with editorials such as The Associated Press and the API relationship with Facebook, the Company has been successful in adopting this transition, as seen in Enterprise increasing from 13% of sales in FY2013 to 30% of sales in FY2016. Although Enterprise growth has slowed in Q2-2017, it remains a growth vector for SSTK.

Pricing & Contributor Royalties

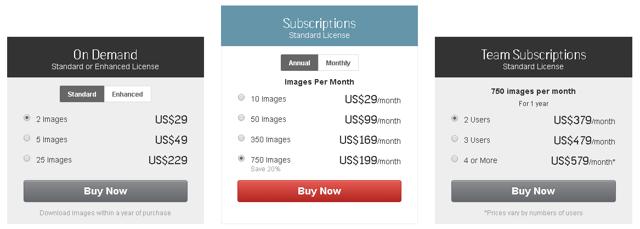

SSTK offers different pricing schemes for their content as seen below.

Exhibit 5: Shutterstock's Pricing Plans

Source: Shutterstock

SSTK offers both Standard and Enhanced licenses. Enhanced licenses offer greater legal rights and reproduction allowances for downloaded content at a multiple of the Standard license's price (~10x more). For Enterprise clients, SSTK offers a more exclusive and tailored solution, which generally involves a dedicated support staff, near-limitless download capabilities, and an enhanced workflow experience.

Shutterstock's contributors are paid each time one of their uploaded photos is downloaded. The Company has a progressive payout system, which is comparable to competitors; as the contributor's lifetime earnings on the Shutterstock platform increase, so does his earnings per image. Contributor royalties are typically ~30% of sales.

Transition to a Broader, More Creative Platform

SSTK has recently completed an overhaul of its old platform onto new technology infrastructure in preparation for its transition to a broader and more creative platform that moves the Company beyond just a stock photo marketplace.

According to management, the goal is for SSTK to become a platform that provides " individuals and enterprises with the various content types and tools needed to collaboratively design, build and distribute their creative projects." Ultimately, SSTK is hoping to become the "one-stop shop" for all stock content and to be more vertically integrated in the creative design process.

According to management, this move opens up new markets and increases the total addressable market ("TAM") to ~$7 billion. Management notes, however, that the current investment in this transition is currently causing heavy opex and capex drags.

As part of this initiative, SSTK has also engaged in several acquisitions over the past few years, as shown below.

Exhibit 6: Recent Acquisitions

Date

Target

Vertical

Value (US$ mm)

27-Jun-17

Flashstock

Creative

$50

15-Jan-15

Premiumbeat

Audio

$32

15-Jan-15

Rex Features

Editorial Imagery

$33

03-Mar-14

WebDAM

Digital Asset Management

$12(1)

Source: Company filings

(1) Purchase price allocation in Shutterstock's Q1-2014 10Q

Industry AnalysisConsolidated Industry – Easy to Enter, Hard to Scale

Pricing remains a major determinant for consumers, particularly for small and medium businesses ("SMBs"), which are more resource-constrained than large enterprises. Each of the three dominant players (Adobe Stock, Shutterstock, and Getty Images) have similar prices on a per image basis (Adobe and SSTK both offer $29.99/month for 10 assets/month).

As a growing amount of amateur photographers and enthusiasts flood the market, the global photo repositories are expected to rapidly expand; this commoditizes digital imagery and causes prices to fall. We expect prices to hold steady at current levels, or increase at very modest rates going forward.

Barriers to entry are very low and are decreasing. There is very little capital required (a website and portal) and specialized knowledge is minimal (imagery is contributed by third-party photographers); therefore, numerous start-ups have entered and have begun crowd-sourcing photos and licensing them out. However, barriers to scalability are high; the largest players have significant resources to spend on marketing and establishing partnerships.

This enables them to effectively shut out smaller players, who offer little to no differentiation in their product. Although smaller players, such as Twenty20, like to claim that "authenticity" is their main differentiator, we believe SSTK would be able to access that niche by leveraging their partnerships with social media sites.

Free Stock Photo Sites Expected to Grow, but Serve Only a Subset of the Market

Numerous firms, including Getty, Shopify, and Hubspot have launched their own stock photo websites, which operate either as loss leaders to generate and redirect traffic to the parent company's brand, or as an independent business (Melcher, Thoughts of a Bohemian).

In the latter case, these sites tend to generate revenue in two ways: 1) Pay-per-click advertising on their website 2) The company advertises on behalf of a traditional stock photo agency (like Shutterstock) and receives an affiliate fee (~15% - 20%) for the sale of a photo (Melcher, Thoughts of a Bohemian). Free stock photos are not expected to become a significant part of the industry, due to their dependency on traditional stock photo agencies for affiliate fees and other factors (e.g. photo quality, site's user interface, etc.).

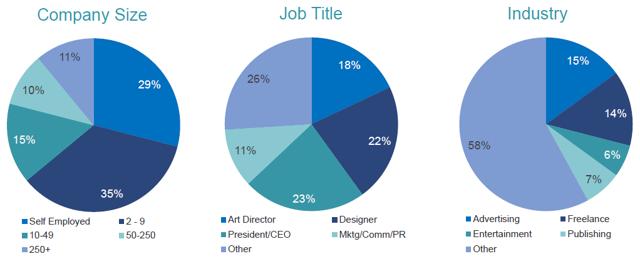

SMBs Remain Largest Consumers of Stock Content

According to management, the total addressable stock photo market, stock music market, and digital asset management market are valued at $6 billion, $ 1 billion, and $1 billion respectively. Users of stock photos include businesses, marketing agencies, editorials, and other adjacent markets. Stock photography find themselves commonly used in ads, front of news stories, websites, and corporate reports. As seen below, the major consumers are SMBs (~79% of total users) and the verticals are quite diversified.

Exhibit 7: Stock Content User Segmentation

Source: Shutterstock March 2017 Investor Presentation

Investment ThesisEvolution to Creative Platform Provides New Avenues for Growth

With lowered FY2017E guidance from management and the bulk of brokers holding a neutral sentiment on the stock, citing uncertainty over the transition and continued short-term margin compression, the market has priced in lower growth prospects and a higher risk profile for SSTK. The last few quarters of disappointing growth represents a natural slowdown in which SSTK's core stock image business has reached terminal growth. However, we align our views with management and believe a successful transition to a broader platform opens new growth vectors that will position the Company as more than just a stock photo repository.

SSTK remains underpenetrated in its growing stock footage and music business (collectively known as "Motion"), as well as custom content. Motion collections are growing at a faster rate than images, and although music and footage command lower margins, with contributor royalties typically ranging from 30% - 50%, the sale per asset is much higher than a traditional licensed stock image (~$49/music track for a standard license and ~$199/clip for a standard license).

As the Company continues to build out and push Motion, we expect to see stagnation in Paid Downloads growth, but an acceleration in Revenue per Download growth. The acquisition of Flashstock for $50 million in June 2017 is a step forward for SSTK, as it represents a formal entry point into custom content, which we see as more of a "service" than a "product," and therefore places SSTK in a better position for differentiation. Furthermore, we believe this is a high margin sub-segment that holds cross-selling opportunities with current SSTK Enterprise clients with more sophisticated needs.

We believe SSTK's core stock library will enable them to execute on the strategy of tackling adjacent market opportunities in the Creative industry through cross-selling their content offerings with creative solution services. The key value proposition here is that the new platform reduces latency between a customer seeking stock content and the SSTK's library of stock content; for example, WebDAM can be integrated with SSTK's library so users can access content straight from the workflow management software, as opposed to having to Google search for stock photos on the web.

This creates a level of convenience and efficiency for marketing/design teams, and therefore allows SSTK to capture a larger share of the client's content budget, while minimizing incremental marketing spend and client acquisition costs. We believe this strategy will help differentiate SSTK by rebranding it as a platform for creative users.

We expect more bolt-on acquisitions down the line, with a specific focus on marketing-based digital asset management software and custom content brands. Based on precedents and the fragmented nature of the target vendor landscape, these acquisitions will likely be within in the $10M - $50M range. With over $250M of cash and short-term investments on its balance sheet, SSTK is in a healthy position to finance further acquisitions. We remain hopeful that the benefits of this new platform will become visible beginning FY2018.

Margin Compression – A Short-Term Compromise

EBITDA margins were at 13.7% of sales in Q2-2017, down significantly from highs of ~23%. We believe the majority of this is due to investment in the transition. Contributor royalty structures have remained relatively stable and operating expenses (opex) is only higher due to spend related to the transition. Depending on the revenue mix, margins moving forward may expand past 23%, as the new lower-volume image download packs entail much higher margins per image (contributors are paid on a set amount for images, as opposed to a % of sale price for Motion) and the business becomes increasingly more scalable.

Shutterstock – Still a Leader in the Stock Photo Industry

Although the global stock photo repositories are growing rapidly and photos are becoming increasingly commoditized, there exists benefits in being an established, legacy player, like SSTK. SSTK has established partnerships that provide long-term value; the partnership with the Associated Press cemented SSTK in the editorial market alongside Getty, and SSTK's API partnership with Facebook entailed zero latency for an advertiser on the Facebook platform seeking to use a stock photo in their ad. Furthermore, with enough marketing spend in SEO to be the top-ranked result in stock photos, SSTK makes it very difficult for any incumbents to achieve large scale success.

SSTK's large and diverse content collection may be an attractive proposition for some customers; however we take the view that collection size is an eroding advantage, because stock photo platforms are becoming overpopulated with images. The focus has now shifted to technology and user interface that enable efficiency in helping the customer find the desired image.

SSTK was among one of the first to react by investing heavily in advanced search technology, which led to image recognition capabilities in their search engine (Adobe Stock has this now as well). However, we believe this is testament to SSTK's agility and flexibility in responding to trends in the quick-changing stock content market.

Undervalued at ~7.5x EV/EBITDA'18E

Given the transition into the creative industry, we believe that the current ~7.5x EBITDA'18E multiple (our estimates) (~8.7x using consensus estimates) that SSTK is trading at is too low. The Company has seen more stable cash flows and higher growth opportunities than peers trading around that multiple; for example, Shutterfly, an image-publishing company with more volatile cash flows and lower growth opportunities, trades at just a notch below SSTK.

We believe SSTK's valuation should move towards that of Adobe, which is trading at ~20.0x EBITDA'18E; although we do not expect SSTK to reach Adobe's level of success, we believe the Company can become a recognized player in Creative.

CatalystsIncrease in Margins and FCF as Spending Lightens

Management did not provide clear guidance on when investment is expected to lighten; however, sometime in FY2018 was implied. If the transition were to be completed earlier and investment spending lightens as a result, we would see sudden margin expansion and an increase in free cash flow.

Accelerated Revenue Growth through Cross-Selling

Although management has noted there has been evidence of the early stages of cross-selling, we expect to see much more activity down the line, with the timing dependent on the speed in which the marketing and sales teams can bring the platform to market.

RisksAdobe Stock Aggressively Expands

Given Adobe's resources and its dominant position in the Creative industry, SSTK may face significant challenges in client acquisition and retention if Adobe decides to further push its offering in stock photography. However, we note that SSTK is still more popular with the stock content market than Adobe Stock is. We see a successful transition to the creative platform as a hedge against this risk, and we believe Adobe is treating its stock photo collection as a small value-add for its Creative Cloud suite and is not interested in fighting with SSTK to be the market leader.

Execution Risk in Platform Transition

Although a good portion of the transition (completion of new tech slack, reorganization of customer verticals, several bolt-on acquisitions, and capital spending) is already complete, we still see some execution risk in completing the platform transition. SSTK's primary job from this point forward will be: 1) Convincing the stock content market that they are a viable platform for creative professionals 2) Successfully integrating any existing and new acquisitions.

Management TeamJonathan Oringer - CEO, Chairman of the Board, and Founder

Oringer founded SSTK in 2003 when he became SSTK's first contributor by uploading some of his own photos as an amateur photographer. With a 47% stake in SSTK, Oringer is committed to the Company for the long-term. In FY2016, he received compensation of $4.5 million (of which nearly all was in the form of option awards). He holds a Master of Science from Columbia University and a Bachelor of Science and Mathematics from Stony Brook University.

Steven Berns - COO and CFO

Berns began serving as COO in March 2017 and as CFO in September 2015. Berns has over 30 years of experience in global financial management, acquisitions, and business operations in large corporations. In FY2016, he received $2.1 million in compensation (of which ~25% was in base salary). He is a CPA and received a Master of Business Administration from the Stern School of Business in NYU and a Bachelor of Science from Lehigh University.

Shareholder Base, Liquidity And Capital Structure

SSTK's shareholder base is very concentrated with significant insider ownership overhang due to Oringer's massive stake in the business. A breakdown of the top ten shareholders is shown below.

Exhibit 8: Top 10 Shareholders

Shareholder

Shares Owned

% of Free Float

Insider?

Filing Date

(Name)

(mm shares)

(%)

(y/n)

(Date)

Jon Oringer, CEO

16.2

46.7%

Yes

31-Mar-17

Jackson Square Partner

2.5

7.2%

No

30-Jun-17

Arrowmark Partners

2.4

6.8%

No

30-Jun-17

Blackrock

2.2

6.4%

No

30-Jun-17

FMR

2.2

6.2%

No

30-Jun-17

Vanguard Group

1.7

4.8%

No

30-Jun-17

Van Berkom & Associate

1.3

3.7%

No

30-Jun-17

BNY Mellon

0.8

2.4%

No

30-Jun-17

Morgan Stanley

0.7

1.9%

No

30-Jun-17

SEI Investments

0.6

1.6%

No

31-Aug-17

Total Identified Investors

30.4

87.7%

SSTK's shares are fairly liquid, with an ADTV of ~142,000 shares and $32.90 VWAP. Short interest is at 4.2 million shares, or 23.4% of free float. As of Q2-2017, SSTK is completely unlevered with $266 million in net cash. The Company has been almost completely debt-free throughout its publicly-traded life and is not expected to take on debt in the near future.

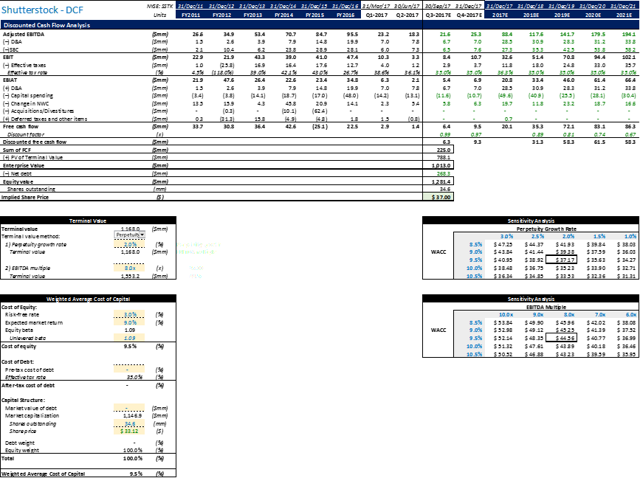

ValuationDiscounted Cash Flow Analysis

We applied a 50% weighting of the DCF to our final valuation. Our DCF implies mid double-digit revenue growth for the next few years, driven mainly by Revenue per Download expansion. We then forecasted high single-digit revenue growth in steady-state. We modelled margins expanding to 23% by steady-state, mainly due to the lightening of investment spending and continued expansion into creative solutions. We expected Capex to revert back to ~4% of sales in steady-state.

Our WACC is 9.5%, derived using CAPM with a 3% risk-free rate, a 6% market risk premium, and a 1.09 equity beta (Damodaran). We used a 2% perpetuity growth rate, and arrived at a $37.00/share target.

Comparable Company Analysis

We applied a 50% weighting of the comps to our final valuation. Because SSTK is the only publicly-traded stock content company, we had some difficulty in selecting a peer group. Ultimately, we chose peers from the Internet sector that operated in a more "creative" or niche industry and had significant market presence. We applied an average of EV/EBITDA'18E (around the time investment spending is expected to level off) to arrive at ~14x, representing a $56.00/share target.

RecommendationWe see Shutterstock as an investment with a much higher upside than downside potential, as the maturity of its core stock image business has already been priced in. With the completion of the platform transition, we expect to see margins expand rapidly and revenue growth accelerate, driven by the Motion business and cross-selling opportunities. With a target share price of $47.00, representing a 41% upside from the current share price of $33.12 and ~11.5x EV/EBITDA'18E, we are recommending a Buy rating on Shutterstock.

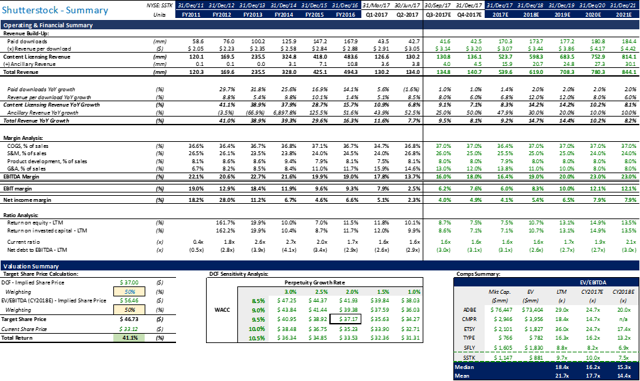

Appendix 1: Consolidated Financial Summary

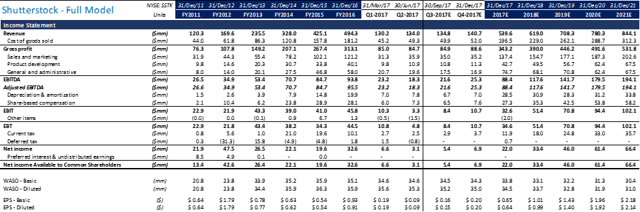

Appendix 2: Income Statement

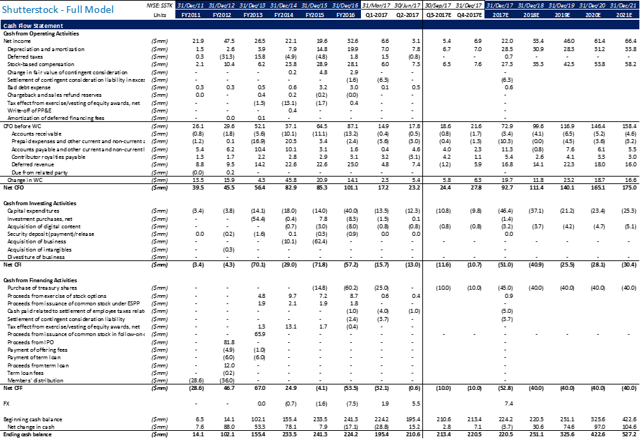

Appendix 3: Cash Flow Statement

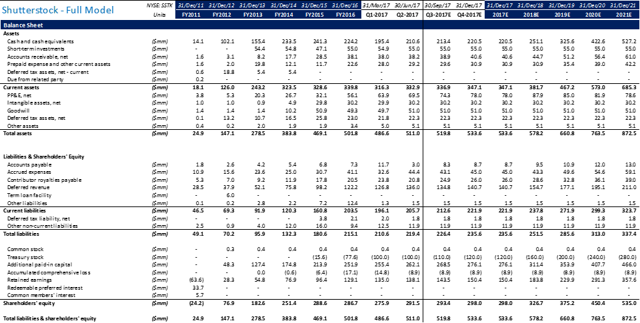

Appendix 4: Balance Sheet

Appendix 5: Key & Non-GAAP Metrics

Appendix 6: Discounted Cash Flow Analysis

Appendix 7: Comparable Company Analysis

Thank you for reading this Seeking Alpha PRO article. PRO members received early access to this article and get exclusive access to Seeking Alpha's best ideas. Sign up or learn more about PRO here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments